LIABILITY COVERAGE

If you're at fault in an accident, this coverage pays for damages to others’ property and injuries. It also covers legal fees if you're facing a claim.

WHY PAY MORE?

Car

Motorcycle

Commercial

Roadside Assistance

Other

Competitive Rates

Industry Expertise

With or Without a License

With Good Credit, Bad Credit, or No Credit

Online/

Phone/

In-Person

Services

Multiple Convenient Locations Near You

If you're at fault in an accident, this coverage pays for damages to others’ property and injuries. It also covers legal fees if you're facing a claim.

It helps pay for the repairs of your vehicle after a crash, regardless of who is at fault, protecting your car from the financial burden of an accident.

From fire and theft to vandalism and animal collisions, it protects your vehicle from a wide array of non-collision-related risks, giving you security.

This coverage helps cover medical expenses, lost wages, and funeral costs following an accident, ensuring financial support, regardless of fault.

MedPay helps cover medical costs after an accident, providing coverage for both you and your passengers, regardless of who is responsible for it.

If you're involved in an accident with an uninsured or underinsured driver, this coverage helps pay for your vehicle’s repairs and medical bills.

It covers the financial gap between your car's loan balance and its actual value if it’s totaled, protecting you from paying more than the car’s worth.

If your car is being repaired due to a covered event, it helps cover the cost of a rental car, making sure you stay on the road without disruption.

It helps you get back on the road when your vehicle breaks down, offering services like tire changes, towing, and jump-starts, so you’re never stranded.

If your car is totaled, it helps you purchase a new vehicle of the same make and model, ensuring you aren’t financially impacted by depreciation.

Consider the wide array of coverage options, policy types, and providers available through our agency to find the protection that suits you best.

Talk to local auto insurance experts in Texas who know your community. They’ll provide you with helpful advice to help you choose the right insurance plan.

Assess insurance quotes and coverage options from various insurers at CINCO to select the most affordable policy that adequately protects your vehicle.

Stafford, TX, located within the Houston metropolitan area, is known for its diverse community and convenient access to both urban and suburban amenities. The city offers a lively cultural scene, a thriving economy, and easy access to major highways, making it an ideal place to live and work.

With the city being close to Houston, residents often face heavy traffic. As a result, auto insurance is essential for safeguarding vehicles. Texas law requires all drivers to have minimum liability coverage, and many locals seek policies that offer both affordability and reliable protection.

CINCO Auto Insurance is a trusted name in the region, offering its residents affordable and customizable car insurance options. Whether you're new to the area or a longtime resident, we make it easy to find the right coverage to suit your unique needs, ensuring peace of mind on the road.

Car insurance rates in the city can vary widely depending on several factors unique to each driver. These factors influence how much you’ll pay for coverage and can cause premiums to differ even for drivers with similar profiles. Insurance companies assess multiple aspects to determine the level of risk associated with insuring a vehicle and its driver, which affects the policy's cost. Understanding these influences can help you manage and reduce your insurance expenses a lot:

Driving History

Age and Gender

Location

Vehicle Type and Model

Credit Score

Coverage Level

Deductible Amount

Claims History

Annual Mileage

Insurance Provider

Marital Status

Type of Driving

Discounts and Bundles

Safety Features in the Vehicle

State Laws and Regulations

Car insurance is vital for anyone driving a vehicle on public roads. Busy streets and heavy traffic increase the risk of accidents, making auto insurance an essential factor for protecting drivers and their cars. It ensures that the necessary support is available to cover damages and legal responsibilities in the event of an incident. This fosters a safer driving environment for everyone on the road. Here is a list of specific individuals who must have an insurance policy:

For Stafford, the minimum required auto insurance coverage is 30/60/25, covering $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. While these limits are necessary for legal compliance, they may not fully cover your costs in the event of a major accident.

Many drivers increase their coverage or add collision and comprehensive insurance to protect against non-collision damages like theft, fire, and vandalism. It’s important to consider your vehicle’s value, potential medical expenses, and driving habits when selecting coverage. Opting for higher limits offers better protection, especially in high-risk areas. Ensure you review your coverage regularly to remain adequately protected.

In Stafford, drivers can take advantage of various opportunities to lower their car insurance premiums. Many insurance providers offer options that can reduce the overall cost of a policy. These savings are often based on different aspects of the driver’s habits, vehicle characteristics, or affiliations. By exploring these opportunities, you can find ways to make your car insurance more affordable while maintaining the coverage you need for protection. Here are some common discounts you can get:

Safe Driver Discount

Good Student Discount

Multi-Policy Discount

Multi-Vehicle Discount

Low Mileage Discount

Defensive Driving Course Discount

Anti-Theft Device Discount

Pay-in-Full Discount

Paperless Billing Discount

Automatic Payment Discount

Accident-Free Discount

Affinity or Membership Discount

New Car Discount

Military Discount

Homeowner Discount

Loyalty Discount

Green Vehicle Discount

Usage-Based Insurance Discount

Senior or Mature Driver Discount

Occupation-Based Discount

In Stafford, car insurance costs may vary depending on the type of coverage. For minimum liability insurance, the average monthly premium is approximately $103, totaling around $1,240 annually. If you are searching for comprehensive protection, full coverage insurance in the city costs approximately $180 per month ($2,160 annually), while the average annual cost in Texas is around $747.

The make, model, and age of your vehicle can also influence costs, as some cars are more expensive to insure due to higher repair costs or a higher likelihood of theft. To ensure you're getting the best deal, it's wise to compare quotes from different insurers and select a policy that offers the proper protection at a competitive price tailored to your situation.

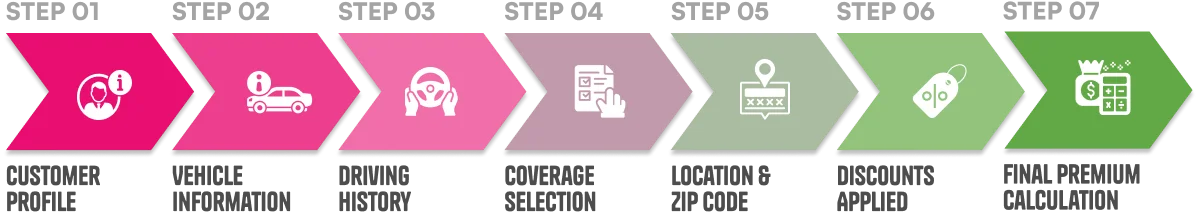

When applying for auto insurance in the city, providing accurate information from the beginning helps prevent problems down the line. Insurers will ask how you use the car, who the drivers are, your driving record, and whether you've had any past claims or coverage gaps. Inaccurate info may lead to higher rates or denied claims. Being detailed helps you get the right coverage. Start strong by sharing all the needed information. Here’s a quick list of what your insurer may ask you during the process:

When comparing auto insurance rates in the city, obtain quotes from several different providers. Each insurer uses its method to assess risk, which means premiums can vary widely for the same level of coverage. Some companies may offer more affordable rates but with less coverage, while others may provide extensive protection at a higher price. To get the best value, it's advisable to compare quotes from multiple insurers. Below is a list of leading insurance companies in Texas and their rates:

Note: These rates are estimates and can vary based on individual circumstances. For accurate pricing, it's recommended that you obtain personalized quotes.

Your vehicle’s make and model influence insurance rates in the city. Key factors such as repair costs, safety ratings, and the likelihood of theft influence how much you'll pay. According to CarEdge, here’s a look at the average insurance rates for popular vehicles in Texas. This information can help you better understand how the type of vehicle you drive impacts your premiums, enabling you to select coverage that meets your unique needs while staying within your budget:

Note: These rates are estimates and can vary based on individual circumstances. For accurate pricing, it's recommended that you obtain personalized quotes.

Start by completing our quick form with details about your driving behavior, such as how often you're on the road and the type of car you drive. CINCO uses this info to narrow down the best auto insurance plans that align with your routine and financial goals.

Soon after, we’ll send you personalized quotes from trusted insurance companies in Texas. With these options, you can choose a policy that not only provides excellent coverage but also fits comfortably within your budget.

Car

Motorcycle

Commercial

Roadside Assistance

Other

Understanding mandatory statistics related to vehicle trends in the city is essential for making informed decisions about car ownership, safety, and insurance. These insights help residents assess risks, identify opportunities for improvement, and stay prepared for potential challenges on the road. By being aware of local trends and conditions, drivers can better direct their options for vehicle purchases, insurance policies, and road safety measures. Here are some key statistics to consider in the city:

01

In Stafford during 2022, there were 2 fatal auto accidents involving a total of 4 vehicles, which tragically resulted in 2 fatalities. (City-Data)

02

In Stafford, the motor vehicle theft rate for 2017 was 291.42 per 100,000 population, a 4.25% increase from 2016. (Macro Trends)

03

US Route 59 near Stafford experiences traffic and road conditions that can affect travel times and safety. (NAVBUG)

04

Most people in Stafford, approximately 76.9% of the population, drove alone to work, with an average commute time of 25.7 minutes. (Data USA)

05

Stafford has a motor vehicle theft rate of 566.9 per 100,000 residents, higher than the national average of 284. (Niche)

06

On average, a crash requiring official reporting occurred every 57 seconds on Texas roads throughout 2024. (Texas Department of Transportation)

07

Every 2 hours and 7 minutes, someone is killed in a traffic accident in Texas, demonstrating the ongoing severity of road safety issues. (Texas Department of Transportation)

08

Injuries from vehicular crashes occur every 2 minutes and 5 seconds, affecting a large number of road users daily. (Texas Department of Transportation)

09

Bicycle-related fatalities decreased sharply in 2024, with only 78 pedal cyclist deaths reported—a 26.42% drop from 2023. (Texas Department of Transportation)

10

Not a single life was lost due to a bridge collapse in Texas throughout 2024, reflecting strong structural stability statewide. (Texas Department of Transportation)

Note: These statistics were accurate at the time of publication and may change over time. Please refer to official sources for the most current data.

With over 7,000+ 5 star Google reviews and counting!

Founded in 1981, CINCO Auto Insurance is a licensed agency proudly serving Texas and Georgia residents with reliable insurance coverage.

Toyota

Ford

Chevrolet

Honda

Nissan

Jeep

Hyundai

Kia

Ram

Subaru

GMC

Volkswagen

Copyright © 2026 CINCO Auto Insurance All Rights Reserved.